What’s the most important thing your insurance policies do for your business?

The obvious answer here is that your insurance policies should protect you from things like fires, accidents, and lawsuits. Unfortunately, insurance is complicated and it’s hard to understand what you’re covered for and what you aren’t.

So when we look at our policies, what we usually see is the type of policy we have and the price we pay for it.

But when we only look at these two things, it’s like we’re seeing this:

And what does everyone know about an iceberg? That 90% of what’s there exists beneath the surface.

Insurance is no different.

The policies we have and the premiums we pay for them are the 10% that lives above the surface. The important parts that tell us when coverage applies – and when it doesn’t – often live beneath the surface.

At Stillwell Risk Partners, we’ll help you go deeper and see beneath the surface. We’ll help you to learn how you can not only truly understand your risk, but to control your risks and the costs that come with it.

How you can you control your Total Cost of Risk?

Total Cost of Risk is a concept that puts insurance in its right place – as part of a Risk Management Plan.

Insurance is not a solution, but a tool that businesses can use to transfer risk from themselves to an insurance company.

Effective Risk Management is an organizational strategy to how you face risk. By thinking more strategically about your risk, you can both defend against threats and take advantage of opportunities.

In taking a Total Cost of Risk approach, we can help your business understand your risk at a deeper level. The premiums you pay for your insurance transforms from an expense to a resource used to inform strategic decision making.

Where do we start?

The first thing that we do with any new potential client is simply have a conversation. The process that we use is not a fit for every business. Not every business is one that we want to work with.

But if you got to this page, there’s a good chance there’s a fit for us to work together.

We start here because we we work closely with our clients throughout the year – not just when your policy comes up for renewal.

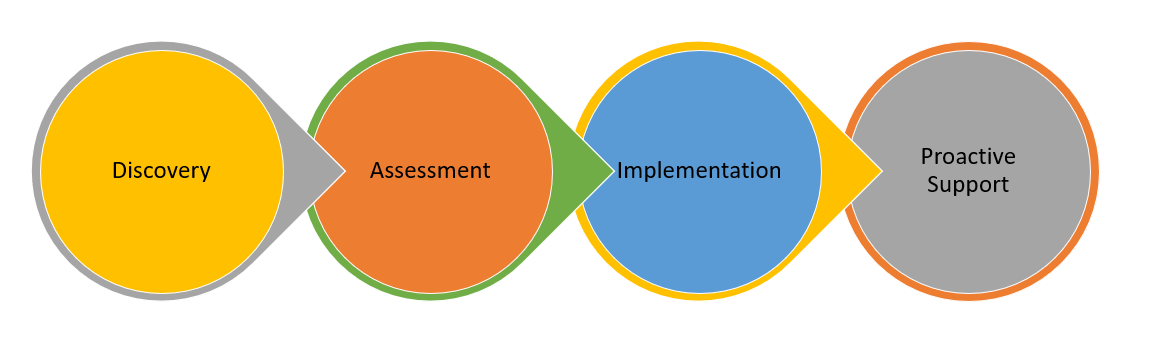

Once we establish a good potential fit with each other, our process works like this:

What Next?

There are a few simple ways to get started:

If you’re ready now, give us a call at (610) 671-3500; or,

Find some time on our calendar below in the next week or two – we’re looking forward to meeting you.