Businesses Need Solutions – Not Products

Insurance policies are products – not solutions. So why is it that most insurance transactions today start with a price quote for a product?

The insurance policies you have and the price you pay for them are the most visible and easily understood parts of any insurance and risk management program. Unfortunately, the policies and premiums are only a small part of what goes into an effective insurance program.

Addressing what lies beneath the surface – the things about your business that drive your costs – is more complicated and frankly, more difficult.

What most businesses do is focus on getting the best price for the coverage they think they need, based on a limited understanding of risk and insurance. The problem with this is two-fold:

- How can you be sure you have the right coverage?

- Where is the risk analysis to help you improve your bottom line?

Obtaining the Right Coverage

When was the last time you completed an Annual Risk Survey? How long has it been since a Risk Assessment was completed for your business?

If these things haven’t been done recently – or have never been done in the first place – how can you really be sure what type and limit for coverage you need?

Insurance applications ask important questions – but most of these are related to the insurance carrier being able to charge the right premium and being eligible for coverage. They’re not designed to determine what type or what limits of coverage you need.

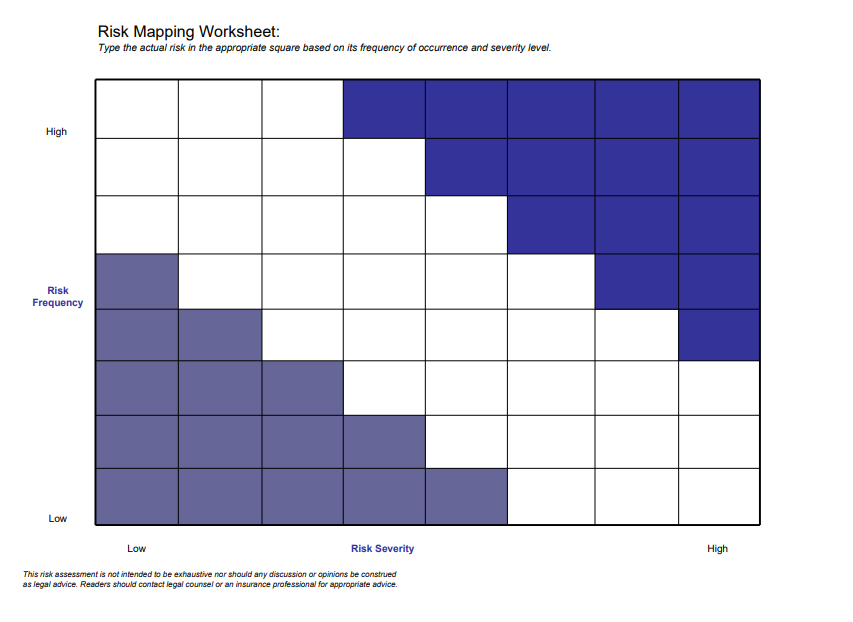

A Risk Assessment is a process that establishes where you are today in managing your risk. A Risk Survey is specific to your industry and your business that establishes what and how much risk you have exposure to. Without these important tools, how can you be sure you have the right coverage for your business if an accident happens or a lawsuit it brought against you?

Improving Your Bottom Line

One common complaint about insurance is that it’s a waste of money if you never have a claim. I think most businesses recognize the need for insurance – you may not like it – but the need for it is hard to argue against. Insurance protects you from financial loss in the event of an accident or a lawsuit. But if you never have a claim, what are you actually paying for?

What if you could leverage the insurance premiums you pay to help you improve your operations? What if it could help you increase profitability?

By pairing insurance with good risk management practices, you can often do just that.

Effective Risk Management isn’t just about responding to threats or mitigating loss, it’s about taking advantage of opportunities to drive change, minimize costs and increase revenue.

Ready to Learn More?

The Risk Assessment 360 Program is designed to solve some of the most common problems businesses have with insurance:

- We’ll help you avoid the trap of the traditional insurance renewal process by eliminating the frustration and giving you control.

- We’ll help you understand your risk and what insurance coverage you actually need.

- We’ll help you leverage the insurance premiums you pay to improve operations, increase profitability and think more strategically about risk.

When you’re ready, give us a call at (610) 671-3500, or book your Executive Briefing here: