Miscommunication is a constant in our lives. It takes different forms, but it’s always there. One of things I talk about a lot is the concept of Risk. But what risk means to me might not be the same as what risk means to you. So let’s explore the topic of: what is risk?

Different Perceptions of Risk

When I was a kid, my dad, my sisters and I would play the board game Risk regularly. Up until my generation started having kids a few years ago, the Game of World Domination was a tradition – and I expect it will be again as our kids get older.

The game itself is a good example of how risk – and our perception, tolerance, and capacity for it – shape the decisions we make.

In the game of Risk, the fewer countries and armies you have means that any action you take comes with considerable risk. Striking out against a well fortified enemy is a dangerous strategy. But staying put and doing nothing comes with it’s own risk because if you don’t expand, you’ll fall further behind.

Finding the right balance may be the best strategy in concept, but following that balance let’s the other players predict your moves. Taking a large risk can be unexpected and catch the other players off-guard, but there’s always chance involved and large risks can result in either large rewards or catastrophic failures.

What is Risk in Real Life?

Here’s where we get to miscommunication. When I talk about Risk, I’m often referring to the threats that exist in the world that can jeopardize a business’ or family’s financial assets. I think of Risk in terms of Risk Management and most often, in the transfer of risk from a business or family to an insurance company.

However, if you work in finance and investments, you might think in terms of how risky certain stocks or funds are.

If you work in the medical field, you might think of the risk assessments you complete on your patients.

If you’re the owner of a business, you might think about the risk of launching a new product or expanding and hiring new employees.

What does risk mean to you?

Where does Risk fit into Insurance?

Probably the better question is: where does insurance fit into your Risk Management Plan?

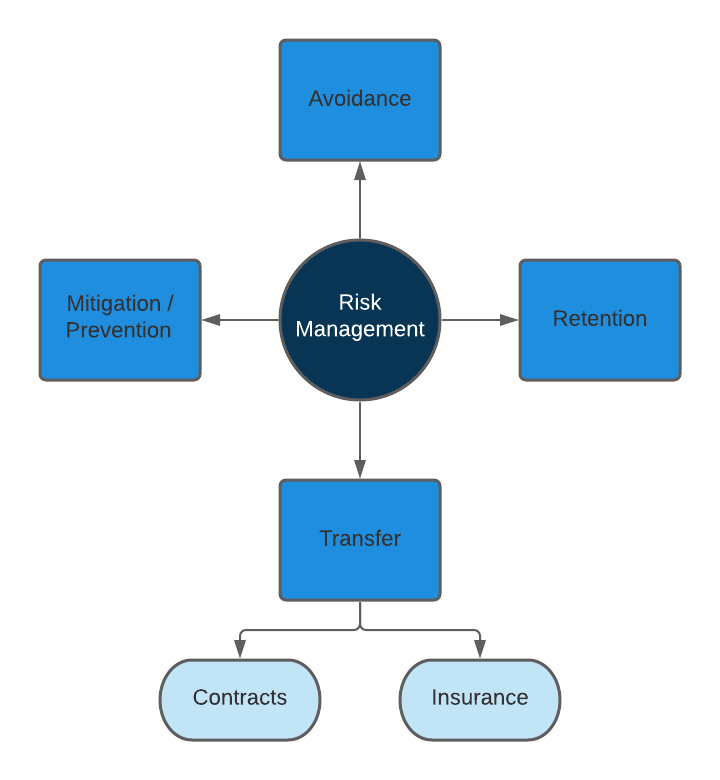

The idea of insurance in my mind might be a little different than yours. I think of insurance in terms of how it fits into a Risk Management Plan. The options for managing risk is typically divided into four general categories: Prevention (or mitigation), Retention, Avoidance, or Transference.

Insurance falls within the category of Risk Transfer, but as you can see, it’s not the only thing that can qualify as Risk Transfer:

There’s a lot of work that goes into developing a solid Risk Management plan for any organization, but even just looking at this framework, it can really start to put things into perspective.

Insurance in and of itself is a not a risk management plan. A good risk management plan helps to inform your decision making process around the type and amount of insurance to purchase.

What is Risk to You?

When you hear the word risk, what does it make you think of? How do you think about risk?